Investment in Your Future: Tuition & Financing at Our School

Making the decision to invest in your education is one of the most significant choices you’ll make. At our school, we believe in complete transparency regarding tuition costs and financing options, empowering you to make informed decisions about your educational investment. This guide provides comprehensive information about our tuition structure, payment plans, federal and private loan options, and additional resources to help you navigate financing your education. We’re committed to making quality education accessible through clear pricing and supportive financing solutions that prepare you for success without unnecessary financial stress.

Understanding Your Tuition Investment

When you enroll at our school, you’re not simply paying for classes—you’re investing in your future career, earning potential, and personal growth. Quality education requires resources: expert faculty, cutting-edge facilities, career development services, and robust academic support. These components create the comprehensive educational experience that empowers our graduates to excel in their chosen fields.

Our graduates consistently report that their investment in education at our institution delivers meaningful returns throughout their careers. According to recent alumni surveys, graduates typically experience salary increases of 40-60% within three years of program completion compared to their pre-enrollment earnings. This significant increase in earning potential demonstrates the tangible value of your educational investment.

Beyond immediate financial returns, our programs provide intangible benefits like professional networking opportunities, industry connections, and skill development that continue paying dividends throughout your career journey. When evaluating the cost of your education, consider both the immediate expense and the long-term value that will accumulate over decades of professional advancement.

Average salary growth for our graduates within three years of program completion

Percentage of graduates employed in their field within six months of graduation

Average student loan debt at graduation, well below the national average

Transparent Tuition Pricing Explained

We believe that understanding exactly what you’re paying for is fundamental to making sound financial decisions about your education. Unlike institutions that obscure costs or surprise students with unexpected fees, we are committed to complete transparency in our pricing structure.

Clear Itemization

Every charge on your student account is clearly labeled and explained, from base tuition to specific course materials. Our detailed billing statements break down costs by category, allowing you to see exactly where your money goes.

Advance Notice

We publish tuition rates for the upcoming academic year at least six months in advance, giving you time to plan and prepare. Any adjustments to tuition are announced with detailed explanations of the factors driving the change.

Cost Guarantee

Our Tuition Promise program ensures that your base tuition rate will not increase by more than 3% annually during your standard program duration, providing predictability for multi-year planning.

Tuition Protection

Once you’ve enrolled for a term, your tuition rate is locked in for that period. You’ll never face mid-semester increases or unexpected surcharges that disrupt your financial planning.

To maintain transparency, we publish an annual Cost of Attendance Guide that outlines not just tuition but also realistic estimates for books, supplies, housing, transportation, and personal expenses. This comprehensive view helps you prepare for the full financial impact of your educational journey. Our financial aid counselors are available to review these costs with you and develop personalized strategies to manage them effectively.

How We Calculate Tuition

Understanding the components that make up your total tuition bill helps you better prepare financially for your education. Our tuition structure is designed to be straightforward while covering the various aspects of your educational experience.

Tuition Component

Description

Frequency

Base Tuition

Core instructional costs including faculty salaries and basic educational resources

Per credit hour/Per term

Technology Fee

Access to campus WiFi, computer labs, learning management systems, and digital resources

Per term

Facility Fee

Maintenance of classrooms,

laboratories, libraries, and

common spaces

Per term

Student Services Fee

Career services, academic

advising, counseling, and

health services

Per term

Program-Specific Fees

Specialized equipment,

software, or resources for

certain majors

Varies by program

Full-time students (those taking 12-18 credit hours per semester) pay a comprehensive rate that offers savings compared to the per-credit rate. Part-time students (taking fewer than 12 credits) pay on a per-credit basis, allowing for flexible scheduling and cost management.

Available Tuition Payment Plans

We understand that paying tuition in one lump sum can be challenging for many students and families. To make your educational investment more manageable, we offer several flexible payment plan options that break your tuition into smaller installments without adding significant cost.

Monthly Payment Plan

Divide your semester tuition into 4-5 equal monthly payments. This option is ideal for those who prefer to align payments with monthly budgeting and regular income. A small $30 enrollment fee applies per semester.

Fall Semester: 5 payments (July- November)

Spring Semester: 5 payments (December- April)

Summer Term: 3 payments (May-July)

Semester Installment Plan

Split your tuition into 2-3 larger payments per term. This plan offers fewer payment dates while still breaking up the full amount. A $20 enrollment fee applies per semester.

- Payment 1: 50% due before classes begin

- Payment 2: 25% due at mid-term

- Payment 3: 25% due before finals

Annual Payment Plan

Cover the entire academic year in 8-10 monthly installments. This comprehensive approach provides the longest payment timeline. A one- time $45 enrollment fee applies.

- Perfect for families who want to plan their entire academic year at once and prefer consistent monthly payments throughout the year.

All payment plans include convenient automatic payment options through bank account withdrawal or credit/debit card. Students can monitor their payment schedule and account status through our secure online student portal, where they can also adjust payment methods and review past transactions.

Benefits of Payment Plans

Our flexible payment plans offer numerous advantages that extend beyond simply breaking up large tuition payments. By enrolling in one of our plans, you gain both financial and practical benefits that can significantly improve your overall educational experience.

Financial Breathing Room

By spreading payments across several months, you can better manage cash flow and avoid depleting savings or emergency funds. This creates a more sustainable approach to financing your education without sacrificing other financial priorities.

Reduced Reliance on Loans

Payment plans can decrease the amount you need to borrow through student loans, potentially saving thousands in long-term interest costs. Every dollar you pay through a payment plan instead of a loan reduces your future financial burden.

Stress Reduction

Knowing exactly when and how much you'll pay creates predictability that reduces financial anxiety, allowing you to focus more fully on your studies rather than worrying about large upcoming payments.

Payment plans also offer practical advantages including automated payment processing to prevent missed deadlines, budget-friendly payment amounts that align with monthly income, and flexible start dates that can be coordinated with your personal financial situation. For many families, these plans represent the most cost-effective way to manage tuition expenses.

Additionally, our payment plans do not require credit checks or affect your credit score, making them accessible to everyone regardless of credit history. The minimal administrative fees associated with our plans are significantly lower than the interest you would accrue on most loans, creating substantial long-term savings for plan participants.

Applying for Our Tuition Payment Plans

Create Your Account

Log into the student portal using your school credentials and navigate to the “Student Accounts” or “Billing” section. Select “Payment Plans” from the menu options to begin.

Select Your Plan

Review the available payment plan options and choose the one that best fits your financial situation. You’ll see a detailed breakdown of payment amounts and due dates for each option.

Provide Payment Information

Enter your bank account information for ACH payments or credit/debit card details. You can designate a primary payment method and an optional backup method.

Review and Confirm

Carefully review all plan details, including payment schedule, administrative fees, and terms and conditions. Confirm your enrollment by providing your electronic signature.

The deadline to enroll in payment plans is typically two weeks before the start of each term, though late enrollment may be possible with an additional fee. Administrative fees are non-refundable once you’ve enrolled in a plan, so be certain about your choice before confirming. For the monthly payment plan, the first payment is due at the time of enrollment, with subsequent payments processed automatically on the scheduled dates.

Our payment plans are legally binding agreements, and failure to make payments may result in late fees, registration holds, or other consequences. However, we understand that financial circumstances can change. If you anticipate difficulty meeting your payment schedule, contact our Student Accounts office immediately to discuss potential adjustments or alternatives before missing a payment.

For assistance with the application process, contact our Student Accounts office at (555) 123-4567 or email studentaccounts@school.edu. Our team is available Monday through Friday, 8:00 AM to 5:00 PM, to provide guidance and answer questions about payment plan options.

Federal Direct Student Loans Overview

Federal Direct Student Loans, administered by the U.S. Department of Education, offer some of the most favorable terms and borrower protections available. These loans are a cornerstone of education financing for millions of students and come in several forms to meet different needs.

Direct Subsidized Loans

Available to undergraduate students with demonstrated financial need. The federal government pays the interest while you’re in school at least half-time, during your grace period, and during deferment periods.

Current interest rate: 4.99% for undergraduate students

Loan fee: Approximately 1.057% of loan amount

- Annual loan limits: $3,500-$5,500 depending on year in school

Direct Unsubsidized Loans

Available to undergraduate and graduate students regardless of financial need. Interest begins accruing immediately and continues throughout the life of the loan.

- Current interest rate: 4.99% for undergraduates, 6.54% for graduate students

- Loan fee: Approximately 1.057% of loan amount

- Annual loan limits: Up to $20,500 for graduate students

To qualify for federal student loans, you must complete the Free Application for Federal Student Aid (FAFSA) each academic year. This application determines your eligibility for loans and other forms of financial aid. Other eligibility requirements include:

- U.S. citizenship or eligible non-citizen status

- Valid Social Security number

- Registration with Selective Service (for male students)

- Enrollment at least half-time in an eligible degree or certificate program

- Satisfactory academic progress as defined by the school

- No default on existing federal student loans

Before receiving your first federal student loan, you must complete entrance counseling to ensure you understand your borrowing responsibilities and sign a Master Promissory Note (MPN), which is the legal document outlining the terms and conditions of your loans.

How Federal Student Loans Work

Understanding the mechanics of federal student loans is essential for making informed borrowing decisions. These loans follow a structured lifecycle from disbursement through repayment, with specific terms that affect your financial obligations.

Once approved, loan funds are disbursed directly to your school, typically at the beginning of each semester. The school applies the funds to your account to cover tuition, fees, and on-campus housing if applicable. Any remaining funds are refunded to you for other educational expenses like books, supplies, and off- campus living costs.

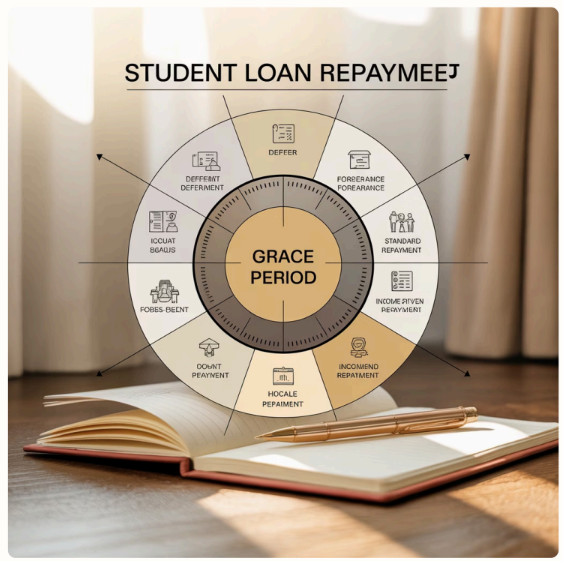

After graduation, withdrawal, or dropping below half- time enrollment, you enter a six-month grace period before repayment begins. This period gives you time to find employment and establish financial stability before making payments. During this time, interest continues to accrue on unsubsidized loans.

Interest begins accruing differently depending on loan type:

- For subsidized loans, the government covers interest while you’re enrolled at least half-time, during the 6-month grace period after leaving school, and during deferment periods.

- For unsubsidized loans, interest starts accumulating immediately after disbursement and continues throughout the life of the loan, including while you’re in school.

Loan Disbursement

Funds sent directly to your school each term. Any excess refunded to you for other educational expenses.

In-School Period

No payments required while enrolled at least half-time. For subsidized loans, interest is covered by the government; for unsubsidized loans, interest accrues.

Grace Period

Six months after graduation or dropping below half-time. No payments required, but interest accrues on unsubsidized loans.

Repayment

Monthly payments begin after the grace period ends. You’ll start repaying both the principal and any accrued interest based on your selected repayment plan.

Parent PLUS Loans for Tuition Support

Parent PLUS Loans provide an additional federal financing option when scholarships, grants, and student loans don’t cover the full cost of education. These loans are specifically designed for parents of dependent undergraduate students who wish to help finance their child’s education.

Loan Features

Parent PLUS Loans offer several distinct characteristics that differentiate them from student loans:

The parent, not the student, is the borrower and legally responsible for repayment

Loans can cover up to 100% of the cost of attendance minus other financial aid received

Current fixed interest rate: 7.54% (higher than Direct Student Loans)

Loan fee: Approximately 4.228% of the loan amount, deducted from each disbursement

Credit check required, though standards are less stringent than private loans

Eligibility Requirements

To qualify for a Parent PLUS Loan, applicants must meet these criteria:

- Credit check required, though standards are less stringent than private loans

- Be a U.S. citizen or eligible non-citizen with a valid Social Security number

- Not have an adverse credit history (though options exist for those with credit issues)

- Student must have completed the FAFSA

- Meet general eligibility requirements for federal student aid

Repayment Options

Parents have several repayment choices:

- Begin repayment within 60 days of final disbursement

- Defer payments while student is enrolled at least half-time and for six months after

- Standard 10-year repayment plan or extended options up to 25 years

- Income-Contingent Repayment possible if consolidated into a Direct Consolidation Loan

For parents with adverse credit history, approval is still possible by obtaining an endorser (similar to a co-signer) or documenting extenuating circumstances for the credit issues. Additionally, parents who are denied due to credit must complete special PLUS Loan credit counseling before receiving the loan.

Alternative (Private) Loan Options

When federal student loans, scholarships, grants, and payment plans don’t fully cover educational expenses, private student loans can fill the gap. These loans are offered by banks, credit unions, state agencies, and online lenders rather than the federal government. While they can provide necessary additional funding, they typically come with less favorable terms than federal options.

Private loans differ from federal loans in several

important ways:

- Interest rates may be fixed or variable and are based on credit score and income

- Many require payments while you’re still in school (though some offer deferment options)

- Most require a credit-worthy cosigner for student borrowers

- Fewer repayment flexibility options and hardship protections

- No access to federal forgiveness programs

- Application processes and deadlines vary by lender

The credit requirements for private loans are typically more stringent than federal options. Most undergraduate students will need a cosigner with good to excellent credit (generally a FICO score of 670 or higher) and a stable income history. The stronger your cosigner’s credit profile, the better interest rate you’re likely to receive.

Cosigner Rate-82%

Percentage of private undergraduate loans that require a cosigner

Interest Range-3-14%

Typical APR range for private student loans, compared to federal rates of 4-8%

Repayment Term-5-15

Common repayment period in years for private student loans

When evaluating private loan options, consider these factors:

- Interest rates: Compare APRs across multiple lenders, understanding how variable rates could change over time

- Fee structure: Look for origination fees, application fees, prepayment penalties, and late payment charges

- Repayment terms: Examine when repayment begins, available term lengths, and options during financial hardship

- Cosigner release:Many lenders allow cosigner removal after a period of on-time payments (typically 24-48 months)

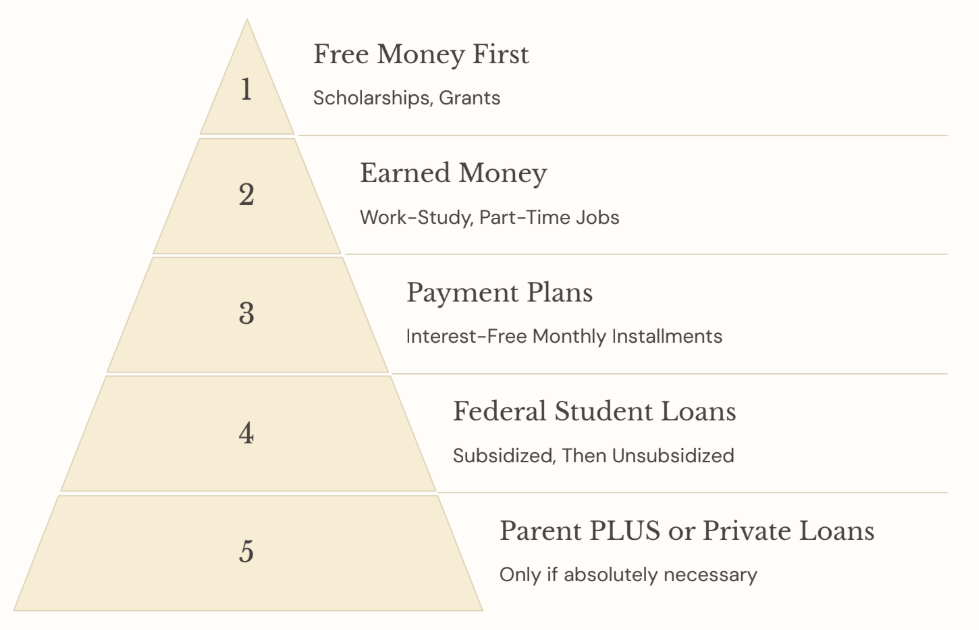

Choosing the Right Financing Option for You

Selecting the optimal combination of financing options requires careful consideration of your personal circumstances, future goals, and financial situation. The right approach balances immediate affordability with long-term financial health, minimizing unnecessary debt while ensuring you can focus on your studies.

This financing pyramid represents the recommended order for utilizing different funding sources. Begin with options that don’t require repayment, then move to those with the most favorable terms before considering higher-cost alternatives. Following this hierarchy helps minimize your total cost of education.

Decision Factors to Consider

Short-Term Considerations

Monthly cash flow requirements for your household

Current employment status and income stability

Availability of family support for educational expenses

Impact on current living expenses and other

Long-Term Considerations

- Projected starting salary in your chosen field

- Total anticipated debt at graduation acrossall education loans

- Expected monthly payment during loan repayment period

- Impact on other future goals (homeownership, family planning)

Tips for Managing Tuition Costs Effectively

Plan Early

Begin financial planning for education at least one year before enrollment. Create a detailed budget that includes all potential expenses, research scholarship deadlines, and establish a savings plan for expected contributions.

Maximize Aid

Submit the FAFSA as soon as it opens on October 1st. Apply for institutional and external scholarships continuously throughout your academic career, not just before freshman year.

Minimize Borrowing

Borrow only what you need for educational expenses, not lifestyle enhancement. Consider part-time work during the academic year and full-time work during breaks to reduce loan amounts.

Track & Adjust

Monitor your spending against your budget regularly. Reassess your financial plan each semester and make adjustments based on changing circumstances or opportunities.

Beyond these core strategies, consider these additional approaches to manage educational costs:

Reduce Time to Degree

Graduating on time or early significantly reduces your total educational costs. Consider these acceleration strategies:

- Earn college credits through AP, IB, or dual enrollment while in high school

- Take advantage of CLEP or other credit-by- examination options

- Enroll in summer courses to stay on track or get ahead

- Maintain a full course load each semester when feasible

- Create and follow a clear degree plan from the beginning

Minimize Additional Costs

Textbooks, supplies, and living expenses can add significantly to your educational budget—plan ahead, seek affordable alternatives, and use student discounts to reduce these expenses.

Understanding Financial Aid Packages

When you receive your financial aid award letter, it’s crucial to understand exactly what’s being offered and how each component affects your educational financing. Financial aid packages typically combine several types of assistance, each with different terms and implications for your future.

Gift Aid

Money that doesn’t need to

be repaid:

Grants: Need-based awards from federal, state, or institutional sources, like the Federal Pell Grant or state education grants

Scholarships: Merit- based awards recognizing academic achievement, special talents, or specific characteristics

Gift aid directly reduces your out-of-pocket costs without future financial obligation, making it the most valuable form of assistance.

Self-Help Aid

Financing options requiring action or repayment:

- Federal Work-Study: Part-time employment opportunities where you earn money for education expenses

- Student Loans: Borrowed funds (federal or private) that must be repaid with interest after leaving school

Self-help aid requires either your time (work-study) or creates future financial obligations (loans).

Expected Family Contribution

The amount your family is expected to contribute based on the FAFSA calculation. This may be covered through:

- Current income and

savings - Payment plans

- Parent PLUS loans

- Private loans

This figure helps determine your eligibility for need-based aid.

A typical financial aid award letter will include a cost of attendance (COA) breakdown, listing the direct costs (tuition, fees, on-campus housing) and estimated indirect costs (books, supplies, transportation, personal expenses). It will then detail each financial aid component being offered and the resulting net cost after aid is applied.

When evaluating your award letter, pay attention to these critical details:

- Distinguish between grants/scholarships (free money) and loans (must be repaid)

- Identify whether scholarships are one-time awards or renewable for multiple years

- Note renewal requirements for scholarships, such as minimum GPA or credit completion

- Calculate your actual out-of-pocket cost after all gift aid is applied

- Compare offers from different institutions based on net cost, not just the total award amount

Avoiding Common Financing Pitfalls

Navigating educational financing can be complex, and missteps can have long-lasting financial consequences. Being aware of common pitfalls helps you make sound decisions and protect your financial future while pursuing your education.

Scam Awareness

Be vigilant about potential financial aid scams. Legitimate scholarships never require payment to apply, and no one can guarantee scholarship awards for a fee. The official FAFSA is always free to complete at studentaid.gov. Be skeptical of unsolicited loan offers or services claiming "exclusive" access to financial aid.

Understanding Terms

Always read the complete terms of any loan or payment plan before signing. Pay special attention to interest rates, repayment start dates, total repayment period, and any fees. Know the difference between fixed and variable interest rates, and understand how interest accrues during school and deferment periods.

Record Keeping

Maintain organized records of all financial aid applications, award letters, loan documents, and correspondence. Keep track of all account information, including loan servicers and account numbers. Document all interactions with financial aid offices and loan servicers, including the name of representatives, date, and summary of discussions.

Additional Pitfalls to Avoid:

- Borrowing the maximum offered: Just because you’re approved for a certain loan amount doesn’t mean you should take it all. Borrow only what you need for educational expenses after exhausting other funding sources.

- Ignoring loan accumulation: Track your total borrowed amount each year and project your total debt at graduation. Understand what your monthly payments will be under standard repayment plans.

Impact of Financing on Credit and Future Finances

Your education financing decisions today will have long-lasting effects on your financial well-being for years or even decades after graduation. Understanding these implications helps you make choices that support your long-term financial goals while meeting your immediate educational needs.

Credit Score Effects

Student loans appear on your credit report as installment loans. Their impact includes:

On-time payments build positive credit history

Late payments can damage your score by 50-100 points

Defaults severely impact scores and remain on reports for 7 years

High loan balances affect your debt-to-income ratio

Future Borrowing Capacity

Education debt affects your

ability to qualify for other

loans:

- Mortgage lenders typically include student loan payments in debt ratios

- High monthly student loan payments can reduce home buying power

- Auto loans and credit cards may be harder to obtain with significant student debt

- Private loan cosigners’ credit is equally affected by your payment behavior

Repayment Planning

Strategic approaches to

minimize negative impacts:

- Income-driven repayment plans for federal loans

- Loan forgiveness programs for qualifying professions

- Employer student loan assistance benefits

- Refinancing options when appropriate

Financial Milestone Delays

Research shows student debt often delays:

- Home purchase (average delay: 7 years)

- Retirement savings contributions

- Emergency fund establishment

- Family formation decisions

- Career flexibility and entrepreneurship

Support Resources Available at Our School

Navigating tuition and financing doesn’t have to be a solo journey. Our institution provides comprehensive support services designed to help you make informed financial decisions throughout your educational experience. From initial planning to graduation and beyond, our dedicated staff and resources are available to assist you at every stage.

One-on-One Financial Counseling

Our certified financial aid counselors provide personalized guidance tailored to your specific situation. Schedule a 30-60 minute appointment to discuss topics like creating a payment strategy, understanding loan options, managing existing debt, or appealing financial aid decisions. Counselors are available in-person, via video conference, or by phone.

Financial Literacy Workshops

Throughout the academic year, we offer interactive workshops on essential financial topics including budgeting for college, understanding credit, loan repayment strategies, and financial planning for post- graduation. These workshops combine expert instruction with practical exercises to build your financial management skills.

Online Resources

Access our comprehensive online financial resource center featuring video tutorials, interactive calculators, document templates, and informational guides. Our student portal also includes a personalized financial dashboard where you can track your aid, view payment schedules, and monitor your progress toward financial goals.

Additional Support Services

Scholarship Office

Our dedicated scholarship team helps you identify and apply for internal and external scholarship opportunities. Services include:

- Curated database of scholarship opportunities updated weekly

- Application review and feedback before submission

- Essay writing workshops specifically for scholarship applications

- Guidance on maintaining scholarship eligibility

Student Employment Center

Finding work that complements your academic schedule can help finance your education while building valuable skills:

- Federal Work-Study position placement and management

- On-campus employment opportunities beyond work-study

- Flexible off-campus job listings with education-friendly employers

- Internship opportunities that combine career development with compensation

How to Get Started with Tuition Financing

Complete the FAFSA

Submit the Free Application for Federal Student Aid at studentaid.gov as early as possible after October 1st for the upcoming academic year. Our school code is 001234. Be prepared with tax returns, W-2 forms, bank statements, and records of untaxed income.

Apply for Scholarships

Complete our institutional scholarship application through the student portal. Additionally, use scholarship search engines like Fastweb, Scholarships.com, and our curated database to find and apply for external opportunities matching your profile.

Review Your Aid Offer

Carefully examine your financial aid award letter, identifying grants, scholarships, work- study, and loan offers. Calculate your remaining cost after all gift aid is applied to determine additional financing needs.

Select Payment Methods

Based on your remaining balance, choose a payment plan and/or loan options that best fit your situation. For loans, complete entrance counseling and sign the Master Promissory Note (MPN) as required.

Confirm Your Financing

Verify that all financing components are in place before payment deadlines. Check your student account regularly to ensure all aid has been properly credited and any remaining balance is covered.

Required Documentation Checklist

For Federal Aid

- Social Security Numbers for student and parents (if dependent)

- Federal tax returns and W-2 forms

- Records of untaxed income (child support, interest income, etc.)

Real-Life Success Stories: Investing in Education

The true value of educational investment is best illustrated through the experiences of our graduates who have leveraged our financing options to achieve their academic and career goals. Their journeys demonstrate how thoughtful financial planning and the right support can transform lives through education.

Marcus Johnson

“I was working full-time when I decided to pursue my degree. The monthly payment plan was a game-changer, allowing me to pay tuition in manageable installments without taking on additional debt. The flexibility meant I could continue working while studying, and I graduated debt-free. My degree helped me secure a promotion within six months of graduating, and I’m now in a leadership role with better pay and long-term growth opportunities. It was one of the best decisions I’ve ever made.”

Jennifer Kim

“My dream of becoming a nurse seemed financially impossible until I connected with the financial aid office. They helped me identify scholarships I didn’t know existed and guided me through the federal loan process. The loan repayment workshop prepared me for managing payments after graduation. Now I’m working at a top hospital in my city, doing what I love, and I’m confidently managing my finances thanks to the support and knowledge I gained during school.”

David Rivera

“Returning to school mid-career was a financial challenge with family responsibilities. The Parent PLUS loan allowed me to focus on my studies without working overtime. The investment paid off when I secured a teaching position that increased my previous salary by 40%. The financial literacy training helped me create a realistic repayment plan, manage my budget effectively, and set long-term goals for my family’s financial future. I’m proud of the example I’ve set for my children.”

Conclusion: Secure Your Future with Confidence

As you consider your educational journey at our school, remember that tuition and financing represent more than just numbers—they’re investments in your future potential, career opportunities, and personal growth. Our commitment to transparent pricing and comprehensive financing support is designed to empower you to make this investment with confidence and clarity.

Transparency Promise

We believe you deserve complete clarity about the costs associated with your education. Our no-surprises approach means you’ll always understand what you’re paying for, with clear itemization, advance notice of changes, and upfront disclosure of all fees and charges.

Flexible Options

Your financial situation is unique, and your financing approach should be too. From payment plans and federal loans to scholarships and work opportunities, we provide diverse pathways to fund your education that can be customized to your specific circumstances and goals.

Long-term Value

The financial investment you make today yields returns throughout your career through enhanced earning potential, professional opportunities, and personal development. Our career outcomes demonstrate that graduates consistently experience significant return on their educational investment.

Expert Guidance

You’re never alone in navigating financial decisions. Our dedicated financial aid counselors, student accounts team, and financial literacy resources are available at every step to provide personalized support, answer questions, and help you develop a sustainable financing strategy.

We recognize that financing your education is a significant decision that extends beyond your time as a student. That’s why our support continues from your first inquiry through graduation and into loan repayment, ensuring you have the resources and knowledge to manage your investment effectively at every stage.

Your education is too important to be limited by financial uncertainty. By providing clear information, diverse options, and ongoing support, we aim to remove financial barriers and empower you to focus on what matters most—your learning, growth, and future success.